The planet of Forex trading can seem challenging for newbies, but it offers incredible opportunities for those prepared to learn and modify. As one of the largest economic markets globally, the particular Forex market functions around the time clock, enabling traders in order to buy and market currencies in quest of profit. Whether or not you're seeking some sort of side income or perhaps aspiring to become a full-time speculator, understanding the basics of Forex trading is essential intended for navigating this active landscape.

In this particular comprehensive guidebook, we will explore crucial concepts and tactics that may empower you to make knowledgeable decisions inside the Forex market. From deciding upon the right loan broker to mastering industry analysis, we can cover everything you need to know to obtain started in your trading journey. With practical tips on risk management, trading psychology, as well as the most effective strategies, you'll be well-equipped to unlock the potential of Forex trading and work towards achieving consistent earnings.

Necessary Forex Trading Tactics

1 fundamental strategy inside of Forex trading will be the trend-following approach. This approach involves analyzing marketplace trends and producing trades that line-up with the applicable direction of the particular currency pairs. Traders use various tools, including moving takes up and trend lines, to identify plus confirm trends. By entering trades in the particular direction of fashionable, traders aim to be able to capture larger price movements, enhancing their very own potential for consistent income. It’s essential in order to remain disciplined and patient when employing this strategy, seeing that trends can final for longer periods.

Another successful strategy is the use of support and resistance degrees. These levels usually are psychological barriers in which the price is likely to reverse or perhaps consolidate. By determining key support and even resistance zones, investors can make educated decisions about entry and exit points. For instance, a new trader might search for buying opportunities when the selling price approaches a strong support level, expecting a bounce back. This approach often incorporates additional indicators to confirm alerts, enhancing the likelihood of the successful trade.

Lastly, a popular strategy among Forex traders is the breakout strategy. This kind of involves entering some sort of trade when the price breaks by way of a significant support or weight level, signaling a potential continuation from the trend. Traders generally look for a strong volume enclosed the breakout in order to increase the reliability of the signal. However, it’s crucial to manage chance when trading outbreaks, as false outbreaks can lead to be able to losses. Combining this kind of strategy with appropriate risk management techniques ensures a more balanced trading method.

Comprehending Forex Market Technicians

The Forex market works on a decentralized community, where currencies are usually traded globally, making it one of the biggest financial markets within the world. As opposed to traditional stock trades, the Forex marketplace does not have physical place; instead, it functions through a system of banks, brokers, and individual traders. This particular allows for continuous trading 24 hours a day, days a week, caterers to participants through various time setting up. As an end result, traders can react swiftly to monetary changes and market news, facilitating elevated liquidity and unpredictability.

One of the key components of Forex trading is money pairs. Traders get one currency although selling another, which often forms a quotation. Major currency sets consist of one of the most traded currencies worldwide, such as the particular Euro up against the US Dollar, and these sets tend to have got the best trading volumes of prints. Understanding how these pairs work is crucial for beginners, as it helps in generating informed decisions about which currencies to be able to trade, the timing of trades, in addition to managing the potential risks engaged.

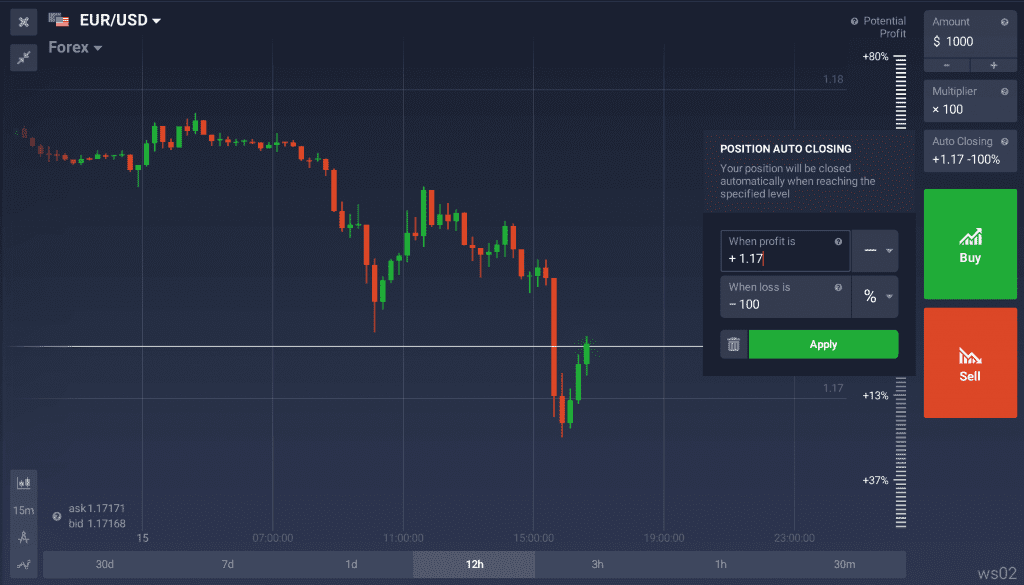

Leveraging is another important aspect of Forex market mechanics. Forex EA enables traders to control large positions along with a relatively little amount of capital, significantly amplifying potential profits. However, leveraging also carries typically the risk of larger losses, making this essential for traders to use it properly. Understanding the technicians of leverage is crucial for any starter, as it helps throughout risk management and even ensures that trading strategies are lined up with one’s financial goals and hazard tolerance.

Managing Risks in addition to Psychology in Forex Trading

Successful Forex trading requires not simply an understanding associated with market dynamics but additionally a solid understand of risk management and psychological strength. One of the particular fundamental principles of trading is to be able to never risk a lot more than you can afford to drop. This involves setting a specific proportion of your trading money for each trade, frequently recommended to always be around one to two pct. By adhering to this particular guideline, traders may withstand losing streaks without significantly affecting their trading company accounts.

Every bit as important is the mental aspect of trading. Emotion can certainly cloud judgment plus lead to energetic decisions that stray from a well-thought-out trading plan. Concern and greed are two major internal barriers that can certainly cause traders to take unnecessary dangers or miss lucrative opportunities. Developing some sort of disciplined trading regimen helps in managing these types of emotions effectively. you can look here should take breaks, assess their trades, and maintain a definite mentality to stick for their strategies.

Lastly, utilizing equipment such as stop-loss and take-profit purchases can significantly aid in managing hazards. These orders handle your exit from a trade that help protect against unforeseen market movements. This kind of systematic approach eliminates some emotional judgements from trading routines. By integrating robust risk management strategies plus mastering emotional manage, traders can improve their odds of long term success within the Forex market.